Reid’s Dome Project

Reid’s Dome Project

Reid’s Dome Gas Project

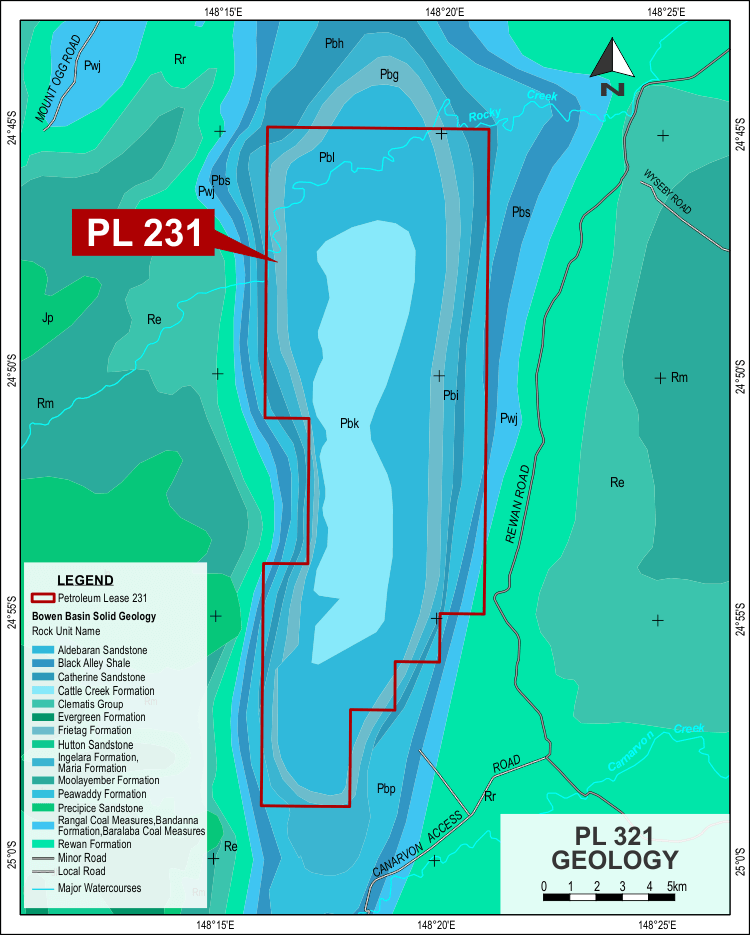

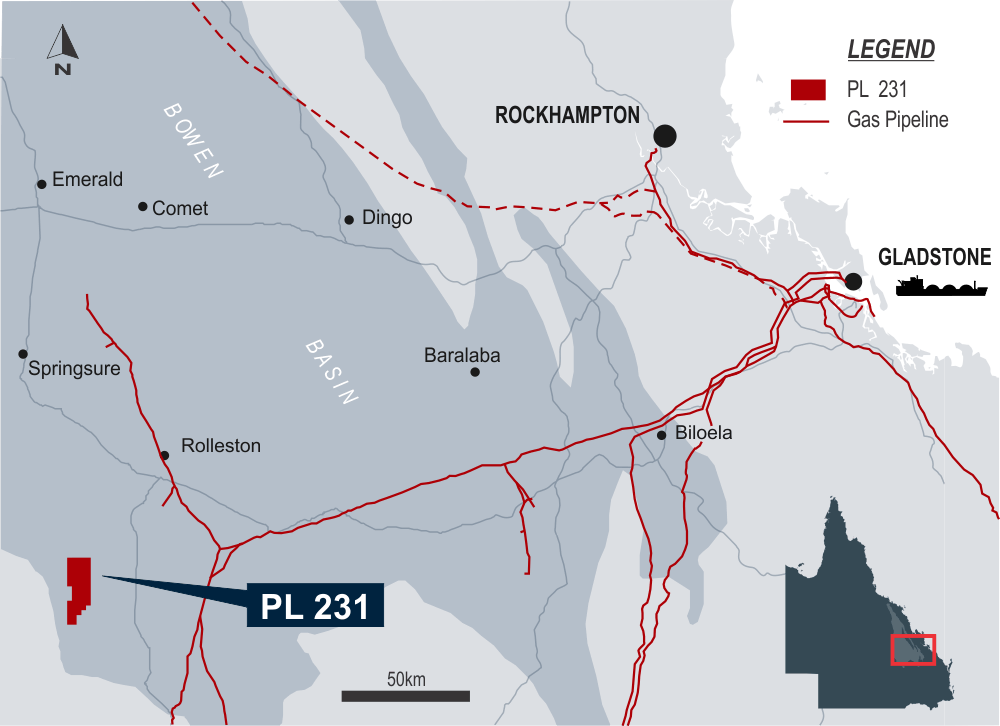

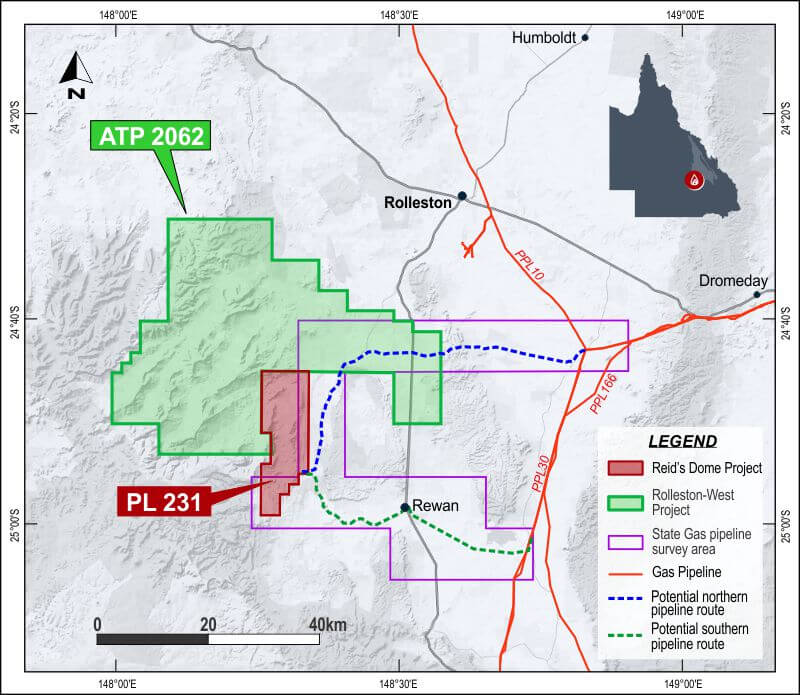

The Reid’s Dome Gas Project is contained within Production Lease 231, located approximately 50 kilometres southwest of Rolleston, in Central Queensland, and 50 kilometres west of the Queensland Gas Pipeline. Reid’s Dome is within the Bowen Basin on the apex of the Springsure-Serocold Anticline.

PL 231 is 100% owned by State Gas, providing the Company with maximum flexibility to drive development.

Geological structure of the Reid’s Dome at PL 231

Conventional gas

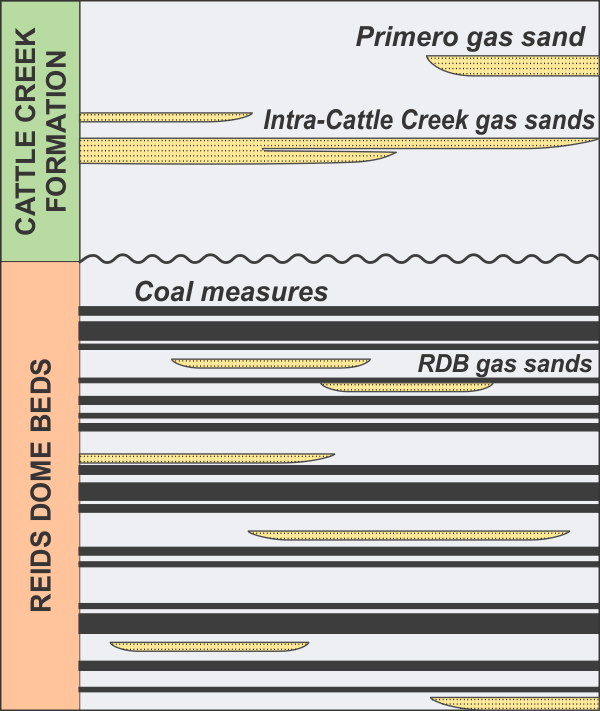

Conventional gas was discovered at Reid’s Dome during oil drilling in 1955, producing gas from gas sands in two zones, the shallow Cattle Creek Formation, a marine sandstone source rock, and the underlying Reid’s Dome Beds. Since that original discovery, a number of historical wells have flowed gas from the Cattle Creek Formation in the northern area of the permit, from depths of as shallow as 130 meters.

Indicative diagram of PL 231 Formations

Coal seam gas

In addition to conventional gas sands, the Reid’s Dome Beds contain extensive Permian coal measures throughout the permit. However, prior to State Gas, the area had not been explored for coal seam gas.

In late 2018 State Gas established the potential for PL 231 to contain a significant coal seam gas project with the drilling of the Nyanda-4 corehole.

In late 2019 the Company commenced a production test of Nyanda-4. In signs which are extremely positive for the commerciality of the Project, sustained gas production commenced after only five days of dewatering, with water production at the lowest end of the range for coal seam gas. Gas flows have consistently increased as the water level (and hence downhole pressure) has lowered. Both the gas flow and low water make are highly encouraging indicators for a commercial project.

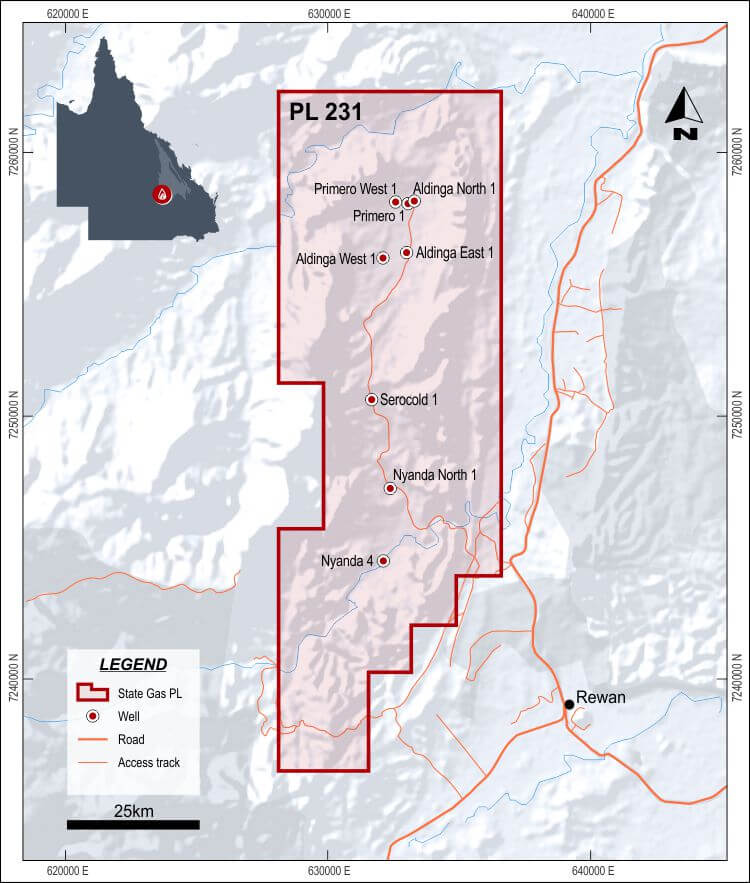

State Gas’ activities have established in excess of 30 m of net coals in the producible zones in the beds (proven to extend below 1100m), with gas contents averaging a very high 13.75m3/tonne dry ash free. Commercial levels of production have been established at the Nyanda-4 well, with stabilised rates of 140mscf/d, punctuated by peaks of up to 700mscf/d. The Company continues to evaluate a range of techniques to successfully liberate gas from the deeper formations. Wells drilled during the 2019-20 and 2020-21 financial years confirmed the continuity of the Reid’s Dome coal seams across the majority of the permit, as well as discovering additional conventional gas in the northern area of the tenement.

Nyanda-4 gas flare – 9 January, 2020

The results of the field activities have been very encouraging. Drilling in the northern and central areas of the permit has confirmed the presence of the Reid’s Dome coal measures throughout the spine of PL 231 with gas content on a par with Nyanda-4.

In order to investigate the potential of coal seams across the permit State Gas drilled the Aldinga East-1A well (approximately 12km to the north of Nyanda-4), and the Serocold-1 well (approximately half way between). Both Aldinga East-1A and Serocold-1 confirmed the presence of coal measures, similar to those at Nyanda-4, in the northern and central domains of the permit. Both wells contain a significant number of seams showing permeability.

The Serocold-1 production test commenced in January 2020 and quickly (within the first week) provided indications of gas production commencing. From the early observations, the Company is confident that the Serocold-1 well will successfully produce CSG.

In a surprise development likely to benefit the commerciality of the field, the Aldinga East-1A well discovered a new conventional gas pool located in approximately 9m of gas sand in the Cattle Creek Formation. A gas sample taken from the well indicated it was pipeline quality gas. In addition to the conventional gas, the Aldinga East-1A well intersected 14.6 metres of net coal. The Company is confident this well will also successfully produce CSG.

In response to an expectation of gas supply shortages to the East Coast market, the Company announced its intention to compress and truck the conventional gas to a location where it can decant into existing pipeline infrastructure (“the CNG Project”). This will allow gas production to commence in advance of construction of a dedicated pipeline and begin to generate modest operating cashflows for the Company at a cost substantially below $12/GJ. All critical equipment for the CNG Project has now been ordered and engineering design is well progressed to allow in-field construction and commissioning to commence in early 2023. It has completed baseline environmental and other studies necessary as part of the development approval process.

The CNG Project will initially produce nearly around 1TJ of gas per day, which State Gas intends to sell into the spot market.

Export pipeline

In August 2018 Pipeline Survey Licence 2028 was issued to the Company, enabling investigations to commence for a pipeline route to market. Work to date has given a high level of confidence that a viable route can be identified and quickly permitted, enabling an early commencement of construction. Discussions with potential pipeline partners have been progressing since the successful production testing results from Nyanda-4 at Reid’s Dome became available.

About Us

Company profile, strategy and future growth

Investors

Investor information, reports and announcements

Shareholder Communication

Important information for shareholders

Sustainability

Workplace health & safety, environment and community